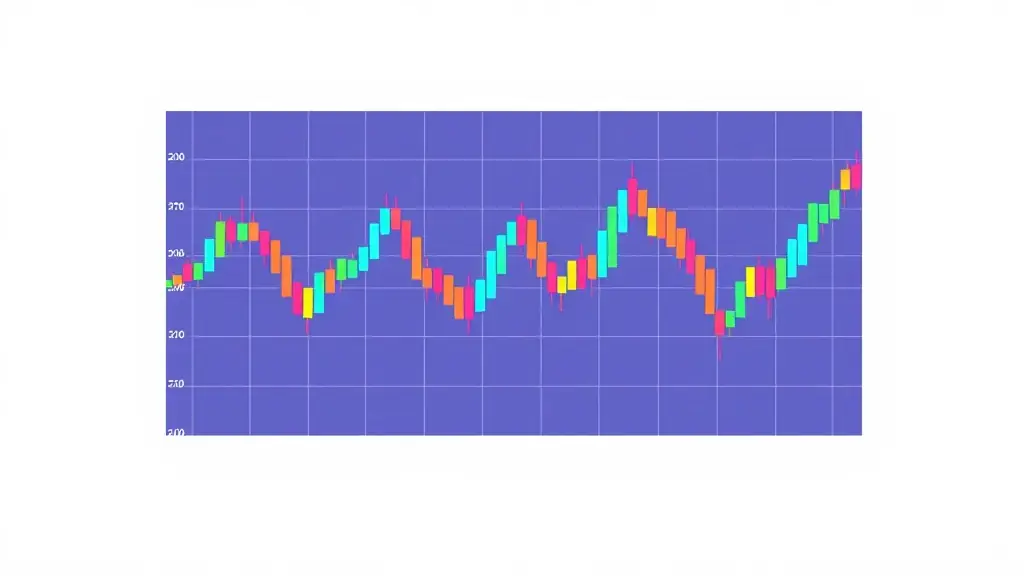

Market volatility is an inevitable part of investing, and knowing how to navigate it is crucial for long-term success. One effective strategy is to maintain a diversified portfolio. By spreading investments across various asset classes, investors can mitigate risk and reduce the impact of market fluctuations. This approach allows for a more stable performance, even during turbulent times.

Another important tactic is to stay informed and remain calm during market downturns. Emotional decision-making can lead to poor investment choices, so it’s essential to stick to your investment plan and avoid panic selling. Regularly reviewing your portfolio and making adjustments based on your long-term goals can help you stay on track. Additionally, consider setting up automatic rebalancing to ensure that your portfolio remains aligned with your risk tolerance.

Lastly, having a clear understanding of your investment horizon can guide your decisions during volatile periods. If you are investing for the long term, short-term fluctuations may not be as concerning. Focus on the bigger picture and remember that markets tend to recover over time. By employing these strategies, investors can better navigate the challenges posed by market volatility.